This post was originally published on my Substack on June 15, 2022. I am moving all my previous posts to Mirror (because it’s awesome!) but you can check out the original here if you are into that kind of thing.

Uniswap Grants Program

Back again.

For those of you that are joining us here for the first time my bear market project has been analyzing grants and incentives programs across crypto. I have a background in working with traditional non profits (I’m Board President at a food bank) and seeing all of these programs piqued my interest.

After a bit of initial review I realized no one was really tracking them so I figured I might as well try. I maintain a list of all the active programs at LlamaoGrants and you can find my research right here on my blog, Sovereign Signal. I think these programs are important to growth and sustainability of our space given we don’t have central authorities (see: governments) providing funding like with traditional grants and figured with my background working in and around these programs and my OCD nature I could start keeping a list and doing some research to uncover more details on what is working and not. You can read a bit on how this all got started on a previous post I did here called The Common Good.

In this report we’ll be diving into the Uniswap Grants Program (UGP), it’s my most comprehensive to date. I’ll start off by reviewing the history of both Uniswap and UGP, and then dive into some details on the current state of the program and - for those looking for further reading - outline main information hubs for a number of UGP-related topics.

Uniswap: Origins

Uniswap was publicly announced by its founder, Hayden Adams, on November 2, 2018 and (roughly) two years later their treasury was online. Late 2018 was really the first time anyone had heard of the project, but for Hayden it represented the culmination of months of work towards something that was, at the time, poorly understood and fairly underappreciated in terms of its potential impact - not only on the crypto space, but the global financial system.

You can hear Hayden’s story from the horse’s mouth in this post that he published on the Uniswap blog back in February of 2019. If you want the TL;DR, I’ve penned a relatively brief overview below; if you already know this ancient (but important!) history, feel free to skip down to the next section for the main course

Hayden was laid off from his first job out of college back in 2017 and felt pretty down and out. His friend, Karl Floersch, was working for the Ethereum Foundation and mentioned to Hayden that he should bone up on things like smart contracts, proof of stake and trustless computation, because there were not many people focused on these issues at the time, and the upside for anyone that crossed this chasm could be huge. I personally found it hilarious that Karl mentioned to Hayden that he was “early”, because - next to verbiage like “HODL”, “diamond hands” and “institutional demand ” - this has been one of the better psyops we have seen emerge from our space over the last few years. Back in 2017/2018, guys like Hayden working on these kinds of problems really *were *early, whereas today all of us just seem to be exit liquidity for our favorite bird app influencers.

Luckily for us Hayden immediately got to work on a “real” project (his words not mine, anon) by putting his efforts into building a first-of-its-kind AMM, as described by Lord Vitalik in this post from his blog. You can actually still check out an early version of Uniswap here if you want to feel some nostalgia for the good ol’ days. Uniswap wasn’t the first DEX (that was Etherdelta) but it marked huge improvement in terms of UX and design, and was eventually featured by his friend Karl at his Devcon 3 talk. Thanks to this presentation,Hayden was introduced to another key member of the story, Pascal Van Hecke, who brought some new ideas to the table and helped with a grant to fund Hayden’s ongoing research and development of the project.

From there, things continued to progress for Uniswap, but the market was changing under Hayden's Feet. The stack of crypto that he was living off of eventually went down 75% from its high (sound familiar?), and he needed additional funding to continue his work.

Hayden eventually found his way to meeting with more key members of the Ethereum Community (including Vitalik), and was able to continue the development of Uniswap thanks in large part to a grant from the Ethereum Foundation. When you look back through the history of grants given by EF, this was probably the one that had the biggest impact on the community, especially considering that the Uniswap Protocol recently passed a total of $1trn in transactions and was in many ways the catalyst for the 2020 DeFi Summer (oh those were the days, anon). All in all, a pretty incredible return on investment from the initial $100K grant.

Some other notable projects that originated from the EF grant program include ENS, Starkware and Gitcoin. EF has also been highly focused on enabling underlying technologies that support scalability, security, usability and privacy improvements to the underlying Ethereum Network. I’m planning on doing a comprehensive review of the Ethereum Foundation and their programs in a future edition so you’ll definitely want to stay tuned for that.

Through determination and perseverance, Hayden was able to finally release his project to the world at Devcon 4 and the rest, as they say, is history. Now, onto the main event: a review of the Uniswap Grants Program (UGP).

UGP: History

Like pretty much all grants and incentive programs, our story begins with a treasury to fund further development, which in the case of Uniswap was established in September of 2020. Many of us primarily remember this as the time of the $UNI airdrop ,but with airdrops usually come grant programs, as they are funded from the same source.

The Uniswap grants program was originally discussed on their governance forum all the way back in December of 2020, in a thread initiated by Jesse Walden of Variant Fund and co-authored by Ken Ng. The program was formally voted on and started accepting applications on January 15, 2021, and was intended to leverage Uniswap’s treasury for further development of the protocol, as well as to help raise awareness and access to the magical world of decentralized finance that Uniswap was at the forefront of.

The original proposal targeted a max cap of $750K per quarter with the ability to reevaluate twice a year at each epoch (two fiscal quarters). Some more details can be found on that initial governance forum post describing the grant program.

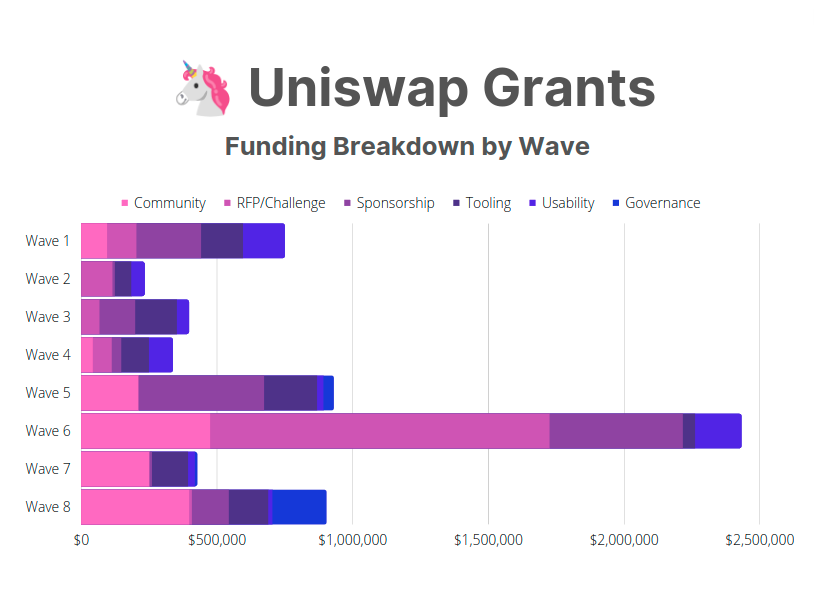

The program operates via the concept of “waves”, although so far there has not been a strict cadence (predefined start/end dates) established for said waves, as the volume of applications and approvals varies according to the UGP team.

Areas of Focus

UGP’s initial areas of focus - based on the initial governance forum post - are listed below:

- General Ecosystem Funding

- Key Components and Integrations

- Core Protocol Development

Upon further review of the program, the information available online and on their Airtable/Notion Site, Wave 9 (the most recent wave) lists the main areas of focus for UGP as:

- Usability - improving the user experience

- Community - growing the ecosystem

- Tooling - improving the developer experience

In addition to these areas, it is also possible for applicants to pursue specific RFP/Challenges or “other” areas that will be reviewed and ultimately approved at the discretion of UGP. Some of these RFP/Challenges include pretty interesting topics like UNI Treasury Management, Inclusion & Access, as well as Security, and might be worth checking out if you are looking for ways to contribute to the protocol.

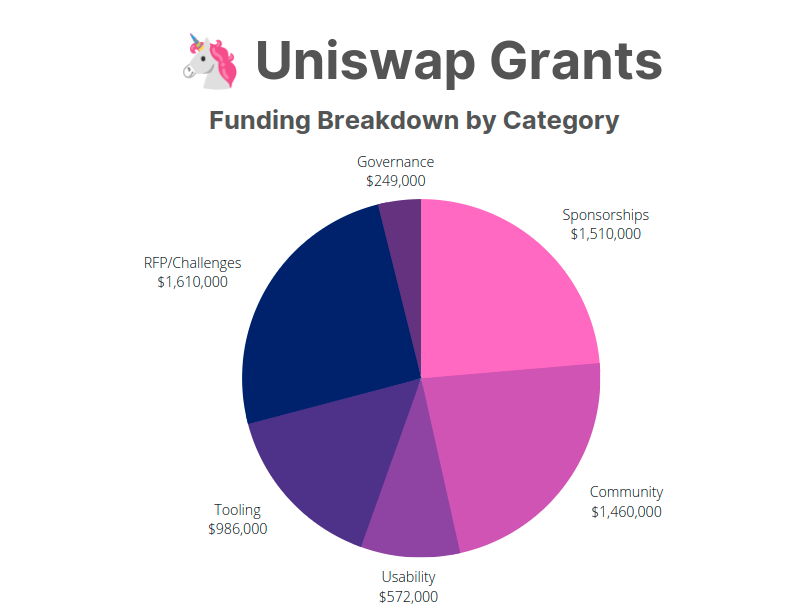

I tallied up the totals across the different categories listed on their notion site, and here’s what the cumulative funding looks like for each category, across all waves, at the time of writing:

In addition to the places UGP directly focuses on, they have been contributing to matched Gitcoin Grants since Wave 9. These are passively matched funding rounds with decisions and disbursements coming directly from Gitcoin contributors/donors, according to the Quadratic Funding rule.

UGP: Disbursements

There is a publicly available notion site along with the project’s Twitter where disbursement announcements are posted; this is where I tallied up the amounts mentioned above from. I also created my own notion site to consolidate the information gathered from the UGP Notion site.

If you add up the sums from that Notion site it shows ~$6.4M in distributed funds across a total of 121 separate disbursements. This total does not include the DeFi Education Fund which was passed as a standalone governance proposal (which means it technically wasn’t even a part of the grants program), or the individual allocations for the Community Analytics program, both of which I review a bit further down in this piece. Those excluded, here’s the breakdown of UGP allocations for each Wave to date:

The assets and distributions are typically denominated in fiat ($USD) but disbursed in $UNI tokens only (following the market rate around the time of disbursement), as UGP exclusively holds and disburses $UNI tokens.

Top UGP Recipients

I thought it might make sense to dive in a bit deeper into some of the top recipients of funds from UGP, so I took a look into all grantees that received $150K or more in funding (9 total), with more information on them below:

Other Internet - Governance Experiments: $1M

- This grant was focused on funding a series of governance experiments and research within the Uniswap community, presenting reports with generalized insights on Decentralized Governance.

- There’s a page that is separate from the UGP site here, and it describes the finer details of this program. If you want the TL;DR, it lists the overall operating principles for this initiative as:

- Focus on increasing the quality (rather than the quantity) of governance proposals

- Create more off-chain affordances for UNI holders to contribute to the ecosystem

- Ensure that each Uniswap entity (Labs, Grants, Governance, working groups, and any future teams) has a clearly defined mandate, which describes its scope and responsibilities

- Help community members who have a wealth of good ideas but not a lot of UNI participate meaningfully in on-chain governance

- In addition to the outline provided on the home page, there are quite a few formal research entries that you can find here. Many of these are very detailed and would have taken considerable time, effort and brains to compile. Definitely worth taking a look.

Ethereum Execution Layer Support: $250K

- This was an interesting proposal where Uniswap partnered with Compound Grants, Kraken, Lido, Synthetix and The Graph to support the Ethereum execution-layer client teams.

- The funds allocated were meant to supplement a significant amount of funding that was already being provided towards this initiative by EF. You can read a bit more on this topic here.

Unicode hackathon: $250K

- This grant was used to fund UniCode, a virtual hackathon focused on the Uniswap Protocol. There’s a blog post here that talks more about the grant and describes the importance of this initiative as an opportunity to bring community members together, so that new projects can be formed that benefit the ecosystem as a whole. You can find more details on the UGP Notion Site Blog.

- All in all it looks like $125K+ in prizes were given out across 96 projects and 351 “Staked Hackers” (their words, not mine anon). There is a blog post on the EthGlobal Medium here with more of the nitty gritty details if you are into that kind of thing.

The Stable Subcommittee: $414K (3 different grants)

- "The Stable" Subcommittee helps provide rewards in the form of increased influence in UNI governance for contributing individuals.

- There are a few pages on their notion site (here and here) with details pertaining to these grants. It was originally established in Wave 2 and they also have a Twitter Account, but it hasn’t been very active since 2021.

- I discovered a YouTube Video with some great information and discussion on this and other topics if you are interested in that kind of thing (like me!)

Unigrants Community Analytics Program: $250K

- Mentioned below in more detail. This seems to be a key area of focus for the UGP program today and looks to continue in future waves.

Rabbithole - L2 quests: $220K (2 grants)

- These grants were created to fund ongoing development of their platform and focused on the creation of many new Layer 2 quests, along with the onboarding of Uni v3 for the Rabbithole.gg platform.

- There isn’t much information available on this grant aside from it being listed on the UGP Notion site.

DeFi Alliance: $150K

- The DeFi Alliance was founded in March 2020 by a team of crypto veterans in partnership with top-tier trading and venture firms that include CMT Digital, Cumberland, JumpCapital, Volt Capital and Coinbase. You can read more about DeFi Alliance’s roots and the team on their website here.

- DeFi Alliance launched their own Grants Aggregator in May of 2021, where builders are able to submit a request and apply for multiple grants from one simple google form.

- The list of projects that have been funded through DeFi Alliance is a proverbial ‘who’s who’ across the space. The program offers Deal Flow, Service Opportunities and Networking Opportunities for builders. You can apply at their website here; the next cohort starts on 9/6/22.

Team Secret: $225K (2 grants)

- Team Secret is an eSports team that has received two grants from UGP totalling $225K. The partnership was aimed at Team Secret creating educational content around Uniswap as well as developing eSports industry activities for the partnership.

- There’s some high level information about the partnership on Team Secret’s blog here, along with various posts on their twitter feed (you can see them using this custom search I created), some mentioning of various Team Secret players as the “Uniswap MVP”

- I wasn’t really able to find much educational content on Uniswap that was created by Team Secret other than the above Twitter posts. They do currently have a banner ad on their site (along with Corsair, Secret Lab, and Tumi) but it just links back to the main uniswap.org page.

Scopelift: $150K

- Scopelift is a software engineering consultancy that specializes in crypto. Their grant focused on various governance upgrades, including spinning off the Uniswap governor as an independent community group.

- This team has a history of design and implementation of governance deployments with their Seatbelt tool, a test suite for governance proposals. You can find more details on this specific grant and the work that Scopelift helped with here.

Community Analytics

One key area of focus that has seen quite a bit of activity is Unigrants Community Analytics. This was an initiative that was originally funded in Wave 7 to the tune of $250K and was intended as a way to help produce analytics that educate the community and drive growth. This program is overseen by a group of five individuals that are listed on their notion site (separate from the main UGP Notion.)

The high level on how this program works is that, typically, the top three submissions get $1500, $1000, and $500 respectively. A capped number of submissions receive participation prizes of $100 each. For "beginner" bounty, a single ‘best submission’ gets $500 (instead of top three), with a higher cap reserved for participation prizes. All prizes are disbursed in $UNI tokens.

There have been a total of 10 bounties rewarded to date, and two are currently open that focus on DEX Analysis and Gas price impacts. Even with the price depreciation of $UNI, the Community Analytics program still has about a $100k budget (in $UNI tokens), and thus will not need a new funding extension just yet. In talking with the UGP team, it sounds like they are hopeful the program can continue past the initial funding allocation as it has been a great way to engage the community around shared objectives that focus on providing better visibility and insights.

DeFi Education Fund

Another Uniswap that received quite a bit of attention was the DeFi Education fund (DEF). It is important to note that this is completely separate from UGP and was voted on as a standalone initiative. Still, I thought it was important to touch on this a bit and provide some context (and ensure everyone realizes it is separate from the work being done with UGP.)

If you are not familiar with the history of DEF, it was an initiative voted on in this Governance Proposal, where 1M $UNI that was given to a 501(c)(4) nonprofit entity based in the United States would provide grants for political, educational, and legal engagement. The vote closed on June 29, 2021 with ~79M UNI voting in favor and ~15M voting against.

The amount given was put into question by many in the community, especially after the fund decided to sell off half of their allocation to sustain operations and fund strategic initiatives. There was quite a bit of back and forth going on between different community members after the initial vote and the subsequent sell off.

In my research on DEF, it seems they have been fairly transparent in regards to their focus and how the money is being allocated to support stated objectives and initiatives. You can find a list of their grant recipients on DEF’s website, along with allocation info on their Medium (which they are transitioning away from) as well as their Substack.

If there is enough interest from the community I could look at digging on this topic a bit more in a future article, and would be happy to engage with DEF if they would be interested. For the sake of keeping the focus on UGP (which again, DEF is outside the purview of) I’ll be moving on.

UGP: Governance

Governance is described in the initial governance proposal in the following way:

- Of 6 committee members: 1 lead and 5 reviewers

- Each committee has a term of 2 quarters (6 months) after which the program needs to be renewed by UNI governance

- Committee functions as a 4 of 6 multi-sig

The initial committee had quite a few names that those familiar with our space would recognize, including Robert Leshner (Compound), Kain Warwick (Synthetix), Monet Supply (MakerDAO), Jesse Walden (Variant Fund) and Ashleigh Schap (Uniswap). Another name that might not be as well known - but should be -is Kenneth Ng.

Ken has been a driving force behind many of the early grant programs and initiatives for the Ethereum Foundation, and someone I personally respect quite a bit as someone who brought his experience from working in the traditional world of grants, including nonprofit and biomedical research. Ken was named as the program lead with other members acting in more of a reviewer capacity. If you are boring (like me!) and enjoy reading through governance posts you can find some really interesting nuggets of wisdom from Ken on his vision for this program, including structure for treasury management, reviewer compensation, and governance.

The committee saw some changes in July of 2021 with Robert, Kain and Ashleigh stepping down due to time constraints. They were replaced by John Palmer, Ariana Fowler, and Callil Capuozzo, with Ken still acting as the program lead. With those changes enacted in July of 2021, this is what the makeup of the committee looks like today (Twitter profiles linked for those I could find):

- Ken Ng

- Jesse Walden

- Monet Supply

- John Palmer

- Ariana Fowler

- Callil Capuozzo

Updates to UGP Governance Over Time

You can see which proposals have been submitted for on-chain governance here. Since the initial 0.1 proposal, there have been only two proposals passed relating to governance function changes (here and here).

The first of these reduced the proposal submission threshold from 10M $UNI to 2.5M $UNI while keeping the quorum requirement static at 40M votes. The community discussions about reducing the amount started in September of 2020 with this in-depth analysis that you can check out if you are into that kind of thing.

The second proposal focused on an upgrade of the core governance contract to Compound’s Governor Bravo from the original Governor Alpha model. Monet Supply wrote a great article that goes into the finer details of this upgrade - or, for the TL;DR, you can just check out the image below (also from that blog post.)

Personal Assessment

I’ll take a bit of time here as we wind this article to a close to give my own personal assessment on the program across a few different areas. These are just thoughts from some guy named Sov so take them for what they are worth. Hopefully I have provided enough information (or at least starting points) in the article for you to draw some of your own conclusions as well.

Program Structure

It is apparent that the overall structure and program mechanics were well thought out from the start. UGP was an early grants program (relatively speaking) for our space and seemed to follow some of the best practices and lessons learned from both the Ethereum Foundation (thanks to Ken’s influence) and more traditional grants programs with roots outside of crypto.

Stewardship of Funds

It does seem like Uniswap had well-defined objectives in terms of where the money was to be spent and how that related back to building the ecosystem and maintaining the protocol. In some places, it appears that quite a bit of funding was given and you do have to dig a bit to find the finer details, as these aren’t necessarily directly linked to the grant awards in the Notion Site (as with the Other Internet site not being directly linked to their grant). As you dig deeper you can find quite a bit of effort and thought going into these programs, and I would think that’s something that UGP would want to celebrate and share - perhaps a bit more than I found them to do.

I was also surprised to see some of the amounts given for sponsorships, including $108K to Bankless (3 grants) and $225K to the eSports group Team Secret (2 grants) that was mentioned above. While I get that you have to pay to play in the attention economy, it still seemed to me like quite a bit of coin (or $UNI) relative to other, more aligned sponsorship opportunities like Hackathons that probably had more impact on growing the Uniswap Protocol and its community, where less funding overall was received.

Finding the Information

I found the UGP contact I was able to work with very accommodating and responsive in helping answer my questions. I was able to work with yj (@uniyj1) after being connected in the Uniswap Discord and they were very helpful in providing me with detailed information you can find throughout this article. Aside from working directly with UGP team members, I found their Notion site, Twitter, and blog articles had almost all the information, even if I had to search here and there to connect the dots or find the finer details.

How to Apply

You can apply at their site linked below or hop into the Uniswap Community Discord and look for the #uni-grants channel if you have questions.

Closing

That’s all for now anons. I hope that this piece was informative and helped provide some perspective on the program. Please stay tuned for more of these kinds of research pieces and please follow me on Twitter and check out my blog, Sovereign Signal if you found this by some other means.

- Sov